Tribune News Service

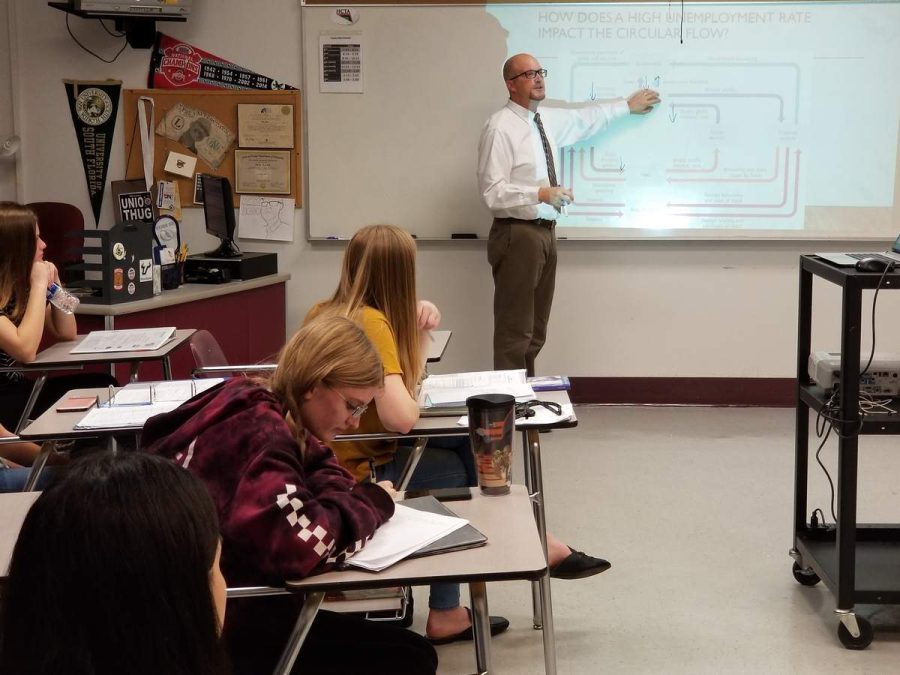

Brandon High School economics teacher Brian Ayres gives a lesson. He said this year that his Advanced Placement macroeconomics students don’t get time to learn financial literacy, because it’s not part of the curriculum. But a new law signed by Gov. Ron DeSantis Monday will ensure every student is taught the topic. Courtesy of Jeffrey S. Solochek/Tampa Bay Times/TNS.

Florida implements new financial literacy half-credit graduation requirement

Currently, high school students in the state of Florida are required to earn eight elective credits as part of their 24-credit requirement for graduation, but as of July 1, 2022, this will no longer be the case. On March 22, the Florida Senate passed SB 1054, otherwise known as the Dorothy L. Hukill Financial Literacy Act. Originally introduced on Jan. 11, 2022, the bill requires students entering high school during and after the 2023-2024 school year to enroll in a half-credit course of financial literacy alongside just seven and a half elective credits, rather than eight.

At this point in time, the states of Alabama, Mississippi, Missouri, North Carolina, Tennessee, Utah and Virginia all maintain the requirement that students must take a financial literacy credit before graduation. Iowa, Ohio and Nebraska are working on implementing and signing into law similar bills requiring finance courses within the next few years.

As of 2019, the state of Florida required that all high school students be offered the option to take a financial literacy “Money Matters” course. Despite this initiative, it was not required that they take the course, just that they are offered the opportunity to.

In hopes of creating more high school graduates who have basic financial literacy and money management skills, better-preparing students for adulthood and easing the effects of nationwide economic challenges, students who enter ninth grade starting the year after next will be required to take this financial management half credit in order to earn their high school diploma.

The act also outlines the updated requirements for the Career and Technical Education (CTE) pathway. Whereas students who began high school prior to the 2023-2024 school year are required to complete two CTE electives or work-based learning programs, one of which may include a financial literacy credit. Students entering high school in the 2023-2024 school year and subsequently must have a half-credit of financial literacy included in their electives.

The act specifies that included in the curriculum for this required course must be lessons in regards to bank account and money management, credit, check bookkeeping, loan applications, inheritance, insurance, taxes, interest rates, contracts, billing, savings and the legality of finance. According to MSD’s current “Money Matters” teacher, Michael Mauro, the course will not have to be modified to meet this criteria.

“It’s a great class that is designed to help you prepare for life, whether you’re going to college, going to work or just for life in general, so don’t be afraid to take the class because you are guaranteed to get something out of it,” Mauro said.

Students believe that they will benefit from having learned financial literacy in high school.

“It is important for [students] to gain those skills for later on in life,” freshman Mia Iusim-Siler said. “It’s going to help them be able to manage their finances better and to be more responsible in the future.”

Broward County Public Schools already required students to take a half-credit of Personal Financial Literacy starting with the Class of 2025, the current freshman class. The state requirement kicks in for the Class of 2027 for all students in the state of Florida.

While these county changes apply to the current freshman class, students are not required to take the class while they are in ninth grade. They are only required to take it before they graduate high school.

“Wait until your junior or senior year to take a class like this because that is when you’ll maximize what you’re going to get out of it,” Mauro said. “Freshmen and sophomores tend to think that getting a car and going to college is so far away that they are a little disinterested in that information initially. However, for juniors and seniors, that’s pretty much right in their faces. If you’re going to take this class, don’t be afraid to wait until you’re a junior or senior so that the things you are learning about are much more pertinent to what you’re going through at that particular point in time.”

With these new requirements, BCPS and the Florida legislature hope to improve the money management skills of high school students in order to better prepare them for adulthood and create more responsible participants in the economy. Current students may contact their guidance counselors in regards to any questions they may have surrounding obtaining their finance credit.