[Opinion] Student debt should be excused for all students

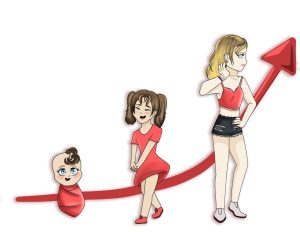

Many students feel burdened by student debt and as if it is never-ending.

October 2, 2022

In the past several decades, student debt has become a crippling factor for millions of American students. This is a problem that affects not only students who are currently attending college, but also those who have graduated years ago; this is an issue that can stay with an individual for the rest of their life.

In its simplest sense, student loan debt is the money owed on a loan that is taken out to pay for educational expenses such as attending college. According to the Education Data Initiative, the average cost of attendance for a student living on campus at a public four year in-state institution is $25,707 per year or $102,828 over four years. This expensive price tag can result in many students turning down their offers due to financial reasons. In many situations, taking out a student loan can be the only way an individual can offset the hefty tuition cost and attend college.

Taking out student loans can be helpful in the sense that they provide numerous students across the nation educational opportunities that they would not have otherwise. However, student loans can become harmful when they become too large to be paid off, resulting in student loan debt. Having student loan debt results in a wide range of often long lasting effects.

One of the many implications of student debt is the constant monthly payments until you pay it off, placing strain on people who live paycheck to paycheck. According to an article posted by Forbes in 2022, 42 million Americans are affected by student debt and this number will only continue to grow as more people are affected by it. More than two million people who are 62 years or older still have student debt that they need to pay off.

Some of the effects of student debt as outlined in an article by Investopedia published in 2022, include how long student debt can last. Student debt lasts until you pay it off or until you die; for those who can’t pay it off, they will have the pressure of paying them for the rest of their lives. According to this article by Ramsey Solutions the average person pays off their student loans over the course of 21 years which means that people in their 40’s with families and kids could still be paying student loans from 20 years ago.

Student debt may prevent individuals from obtaining a job. When employers do a background check, they may also check if you are late on any of your student loan payments. If you have outstanding student loan payments this can also lower your credit score, meaning you can be denied loans for houses and cars amongst other things. These are issues that future college graduates have to deal with that have the ability to put a pause on their lives.

As a result of the issues that student debt has caused, the Biden administration has attempted to alleviate some of the pressure of student loan debt through a set of executive orders. However, while this is a step in the right direction, it just doesn’t provide enough to really help people.

According to a 2022 statement on White House website, the first act of this plan is to take off $10,000 to $20,000 worth of student debt for those who have been recipients of a Pell grant, which is provided by the Federal government for those who may not be able to attend college under their current circumstances. The second act of the plan is cuttingthe cost of undergraduate loans in half and lowering the cost of a four year college. These acts would relieve some of the pressure placed on students.

While the act outlines a solid plan, there are so many more things that need to be done. Especially considering Federal student loans make up about 92% of all outstanding student debt. This student loan portfolio totals 1.6 trillion dollars and has about 43 million borrowers. They have the authority to cancel it. If they did this, it would provide many people relief as it would take a weight off their back that could have been there from one year ago to 50 years ago.

Student debt can completely erase your chances for going to grad school.If you have too much student debt from your undergraduate degree, it could make it unrealistic to take on another massive loan. The worst part about this is that going to grad school and getting a graduate degree could make the difference between having a low to middle salary and having a salary which could allow you to live comfortably or even wealthy. However,this creates an issue where if you have too much student loan debt then you can not get into a grad school, but then you wouldn’t be able to make enough money to pay off your debts in a timely manner.

If student debt is canceled then all of the problems outlined in this article would disappear for millions of Americans. More people could start getting on with their lives where student debt put it on hold and it would provide so much relief for many families still struggling with it.